Among the racial injustices spotlighted in the wake of George Floyd’s killing in 2020 was the economic inequality that has kept Black communities from prospering like others. Corporations pledged as much as $350 million, by some accounts, to helping redress the racial wealth imbalances by investing more in Black businesses.

Corporations have pledged as much as $350 million to Black businesses.

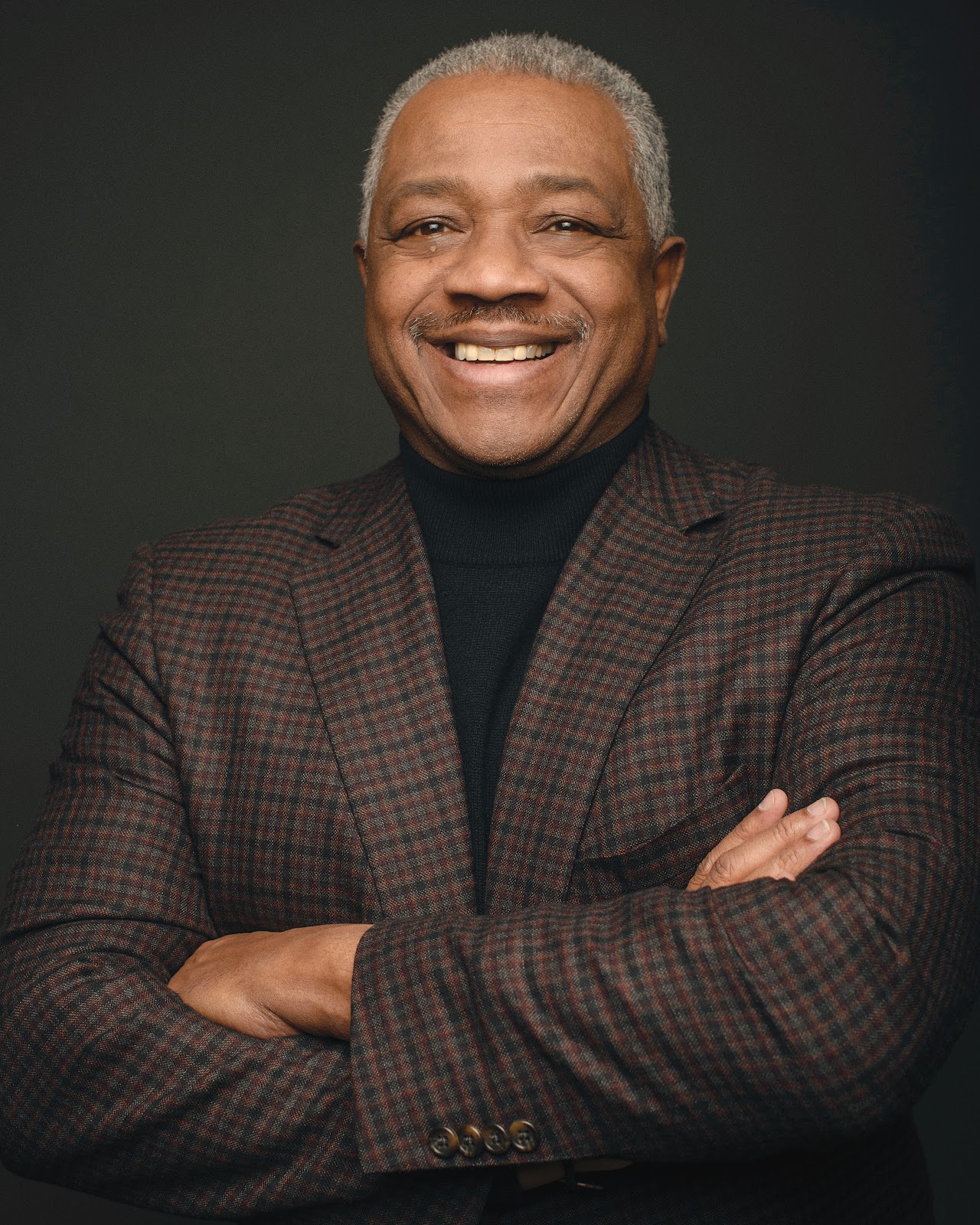

DEREK BATTS

With the jury still out on how well that promise has been kept, Black-led entrepreneurs have been taking things into their own hands to provide new opportunities for both building individual wealth and releasing a new wave of minority entrepreneurs who can help change the world.

Among those seeking to make a difference is Derek Batts, a money manager whose investment strategy at his firm, Union Heritage, has regularly outperformed the big Wall Street firms over the past 33 years. His success led to the business being acquired in 2010 by Morgan Stanley, where he served as a senior vice president for almost a decade.

But the events of 2020 spurred him to want to be more involved in helping close the racial wealth gap by focusing more on minority investors and entrepreneurs, taking the company back into private ownership.

The Union Heritage name speaks to its core business and history, primarily serving local government and union pension funds representing more than 10,000 active employees. Both of Batts’ parents were union members (a teacher and a postal worker), “and what gets me excited is knowing that what we are doing is going to impact the quality of life of the person who’s changing the lightbulbs on the city street for a living; this is how they are able to raise their family,” he says. “There’s nothing more satisfying.”

However, while he has one eye on providing for people’s retirements and ensuring they have wealth to pass on after they die, the other is looking to leverage the assets he manages to make a difference not only on a personal level but community-wide.

As a result, Union Heritage’s focus is not just on good investment returns, important as they are, but often realizing them through investments that make a difference for others. “There is so much talent held hostage in corporate America,” says Batts. “We’re passionate about helping people start and grow sustainable businesses and create generational wealth so they may engage in philanthropic investments that benefit their communities.”

There is so much talent held hostage in corporate America.

Saving Lives

Union Heritage isn’t just advocating for and managing change in the financial world; it’s modeling it. The venture arm of the company—based in Detroit, Michigan—is 80% African American- and 51% women-owned and led. It is also intergenerational: founder and CIO Batts’ daughter, Nia Linder Batts, was recently appointed chief operating officer.

The two (who have an ownership interest in WayMaker Media, publishers of this magazine) are also partners in the company’s Union Heritage Ventures (along with actress and activist Sophia Bush, Joshua Tooker, and WayMaker Journal publisher Louis Carr), which has a focus on helping early-stage founders from underrepresented communities or businesses tackling problems in them.

Among the promising new businesses they are investing in across the consumer, technology, life sciences, mobility, and climate tech fields is JustAir, based in Detroit, which provides air quality monitoring data and is currently running the largest pilot project of its kind in the country.

The company was co-founded in 2021 by CEO Darren Riley, a Carnegie Mellon University information systems graduate, who developed asthma in his mid-twenties from living in a polluted area. As a result, “this problem of quality breath has always been top of mind for me,” he says, noting that the COVID-19 pandemic “really highlighted the state of social and health disparities that people faced in the U.S.”

JustAir has a $2.1 million contract with Wayne County, Michigan, to distribute 600 fixed and mobile monitors across the area to gather data that can help shape better health policies. “We aim to close the gap of social determinants of health as it relates to local sources of air pollution,” says Riley.

He is grateful for the Union Heritage support. “It is significant for us to have an investor who empathizes with the problem space,” he says. “I think that many innovations that solve underrepresented problems go overlooked because, often, the investor class may not have a personal relationship to the problem space… this investment is important as it sends a signal to the market that this problem is worth being solved.”

The JustAir initiative “is literally saving lives,” says Batts. “We want to create thousands more of these kind of opportunities for entrepreneurs.” For general partner Bush, investing into early-stage companies like JustAir and getting more diverse investors “is vitally important to our nation’s future,” she says, “not only in addressing the gender and racial wealth gaps, but in creating the next generation of businesses that are going to change the world.”

Investing into early-stage companies like JustAir and getting more diverse investors is vitally important to our nation’s future, not only in addressing the gender and racial wealth gaps, but in creating the next generation of businesses that are going to change the world.

SOPHIA BUSH

Defining Moment

Batts knew from a young age that he wanted to work with money, but when he graduated from Wayne State University with a degree in finance and went looking for a job on Wall Street, “there was nobody managing money that looked like me.” (Fast forwarding to today, he notes that 98% of the over $80 trillion in United States assets under management is in the hands of “white men.”)

Determined to change things, Batts decided to strike out on his own. He went back to school to get his JD and practiced law for several years to support his fledgling investment firm until he had enough momentum to go full-time. Over the past three decades, Union Heritage has earned a solid reputation in the investment world. With over 100 quarters of cumulative out-performance, it has consistently posted top quartile and often top decile performances. Batts attributes that to “a disciplined approach where we can take emotion out of the decision-making,” with an emphasis on a low volatility approach focused on mitigating risk that generates a higher conviction with each investment.

His success in the financial world has been fueled in part by an early failure. While practicing law, he ran for a judgeship as one of the youngest-ever candidates. “It was a defining moment in that I had the courage to take a calculated risk,” he says. “I gave it my all, and even though I didn’t win, I knew that things were going to be all right. I knew I had the potential to take the calculated risk and be OK, to fail forward.”

With a solid track record behind him, Batts believes it is time to think bigger, noting that for too long “we haven’t had access in our communities . . . to some of these fast-growing companies that can solve big problems.” It’s about scalability: “My wife and I often discuss the difference between a good business and a scalable one. There’s nothing wrong with a business that solves a small problem, but sometimes we limit ourselves, and I’d like to see us begin to think about solutions for larger problems.”

Instead of making $200-$300 a month each on a couple of duplexes, you could make $100 a month per unit on 500 units.

He uses real estate as an example. Someone buys a house, rehabs it and then rents or sells it and invests in a couple more properties. “That’s great,” he says, but what about dreaming bigger? “How do we begin to train ourselves to look at the 400-unit, the 500-unit apartment complex, where it may take a little more capital?” Instead of making $200-$300 a month each on a couple of duplexes, you could make $100 a month per unit on 500 units —while solving a housing problem at the same time. “We need to understand that unit economics are important.”

Making that kind of shift in thinking needs to start young, he says—which is why Union Heritage has long promoted financial literacy in junior high schools: there is “an urgent need to mentor the next generation,” he believes. The firm had historically offered a 10-week course that emphasized the financial fundamentals of budgeting and discipline—the basics matter whether you’re responsibly handling a small allowance or a big inheritance.

Funding Growth

Growing up, Linder Batts’ parents emphasized to her the importance of a good education, and her involvement in a wide range of community programs made her aware early on “that some people have more resources than others.” And that “things are the way they are because this is the legacy effects of the system that’s working for some people and not others… I understood that the deck was stacked.”

Her parents also stressed the importance of financial literacy (“If I wanted to go on a trip or if I wanted to go shopping, I remember putting together a PowerPoint presentation to sort of make my case, and it would often have a breakdown of costs, what we were going to do.”) but she didn’t envision a financial career at that stage.

Linder Batts wanted to tackle economic disparities through media, studying film at Columbia University before beginning her master’s at the University of California, Berkeley’s Haas School of Business. In between, she spent several years at Viacom (now Paramount Global), where she was the youngest-ever executive on the senior management team. Pursuing her entrepreneurial side, Linder Batts launched Detroit Blows, an inclusive salon, with partners Katy Cockrel and Sophia Bush, before joining her father at Union Heritage.

DEREK BATTS: MY WAYMAKERS

I had very supportive and very patient parents, and a godfather [an attorney] who exposed me to the law. I had a mentor in the business about 30 years ago who took the time to sit down with me and help me refine the discipline model that I utilize. He didn’t have to do that; he was just a tremendous person. Equally important is a wife that shares my passion for creating a more equitable entrepreneurial ecosystem. Relative to the importance of legacy, the importance of giving back, the importance of philanthropy, I’ve had a number of waymakers, probably approaching 10 or more. (It is invigorating to address some of these problems and grow a solutions business with a daughter that is uniquely talented and equally passionate about these issues.)

NIA LINDER BATTS: MY WAYMAKERS

My dad and my uncle [Louis Carr] are two of my waymakers. I think they both knew that their paths were never going to be mine, but that somewhere in the middle something interesting would happen. And so they exposed me to their businesses at a very early age. My best friend and our business partner, Sophia Bush, is also a waymaker: she’s probably my biggest cheerleader, after my mom. Similarly, they both put their money where their mouth is, and neither runs away from a fight.

WHAT ABOUT CRYPTO-CURRENCIES?

Union Heritage has not invested in digital currencies, just as it avoids doing so in public utilities, for reasons that might be said to be two sides of the same coin.

“The utility sector is one that we have not invested in because I have a hard time investing in a sector, in a company, where there’s regulation around the level of profitability they can have,” explains Batts. “The reverse of that [is true] for Bitcoin. . .. We try to invest in companies that we think will have the potential for significant growth over the next seven to ten years due to the economic moat around their business.”

Around 40% of the Union Heritage portfolio investments date back 15 years or more. “It’s a high conviction, long-term portfolio,” says Batts. “For Bitcoin, we have had challenges relative to its valuation and the lack of regulation.”